Chapter 8: Winningest Methods in Time Series Forecasting¶

Compiled by: Sebastian C. Ibañez

In previous sections, we examined several models used in time series forecasting such as ARIMA, VAR, and Exponential Smoothing methods. While the main advantage of traditional statistical methods is their ability to perform more sophisticated inference tasks directly (e.g. hypothesis testing on parameters, causality testing), they usually lack predictive power because of their rigid assumptions. That is not to say that they are necessarily inferior when it comes to forecasting, but rather they are typically used as performance benchmarks.

In this section, we demonstrate several of the fundamental ideas and approaches used in the recently concluded M5 Competition where challengers from all over the world competed in building time series forecasting models for both accuracy and uncertainty prediction tasks. Specifically, we explore the machine learning model that majority of the competition’s winners utilized: LightGBM, a tree-based gradient boosting framework designed for speed and efficiency.

1. M5 Dataset¶

You can download the M5 dataset from the Kaggle links above.

Let’s load the dataset and examine it.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

plot_x_size = 15

plot_y_size = 2

np.set_printoptions(precision = 6, suppress = True)

date_list = [d.strftime('%Y-%m-%d') for d in pd.date_range(start = '2011-01-29', end = '2016-04-24')]

df_calendar = pd.read_csv('../data/m5/calendar.csv')

df_price = pd.read_csv('../data/m5/sell_prices.csv')

df_sales = pd.read_csv('../data/m5/sales_train_validation.csv')

df_sales.rename(columns = dict(zip(df_sales.columns[6:], date_list)), inplace = True)

df_sales

| id | item_id | dept_id | cat_id | store_id | state_id | 2011-01-29 | 2011-01-30 | 2011-01-31 | 2011-02-01 | ... | 2016-04-15 | 2016-04-16 | 2016-04-17 | 2016-04-18 | 2016-04-19 | 2016-04-20 | 2016-04-21 | 2016-04-22 | 2016-04-23 | 2016-04-24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | HOBBIES_1_001_CA_1_validation | HOBBIES_1_001 | HOBBIES_1 | HOBBIES | CA_1 | CA | 0 | 0 | 0 | 0 | ... | 1 | 3 | 0 | 1 | 1 | 1 | 3 | 0 | 1 | 1 |

| 1 | HOBBIES_1_002_CA_1_validation | HOBBIES_1_002 | HOBBIES_1 | HOBBIES | CA_1 | CA | 0 | 0 | 0 | 0 | ... | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 0 | 0 |

| 2 | HOBBIES_1_003_CA_1_validation | HOBBIES_1_003 | HOBBIES_1 | HOBBIES | CA_1 | CA | 0 | 0 | 0 | 0 | ... | 2 | 1 | 2 | 1 | 1 | 1 | 0 | 1 | 1 | 1 |

| 3 | HOBBIES_1_004_CA_1_validation | HOBBIES_1_004 | HOBBIES_1 | HOBBIES | CA_1 | CA | 0 | 0 | 0 | 0 | ... | 1 | 0 | 5 | 4 | 1 | 0 | 1 | 3 | 7 | 2 |

| 4 | HOBBIES_1_005_CA_1_validation | HOBBIES_1_005 | HOBBIES_1 | HOBBIES | CA_1 | CA | 0 | 0 | 0 | 0 | ... | 2 | 1 | 1 | 0 | 1 | 1 | 2 | 2 | 2 | 4 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 30485 | FOODS_3_823_WI_3_validation | FOODS_3_823 | FOODS_3 | FOODS | WI_3 | WI | 0 | 0 | 2 | 2 | ... | 2 | 0 | 0 | 0 | 0 | 0 | 1 | 0 | 0 | 1 |

| 30486 | FOODS_3_824_WI_3_validation | FOODS_3_824 | FOODS_3 | FOODS | WI_3 | WI | 0 | 0 | 0 | 0 | ... | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 1 | 0 |

| 30487 | FOODS_3_825_WI_3_validation | FOODS_3_825 | FOODS_3 | FOODS | WI_3 | WI | 0 | 6 | 0 | 2 | ... | 2 | 1 | 0 | 2 | 0 | 1 | 0 | 0 | 1 | 0 |

| 30488 | FOODS_3_826_WI_3_validation | FOODS_3_826 | FOODS_3 | FOODS | WI_3 | WI | 0 | 0 | 0 | 0 | ... | 0 | 0 | 1 | 0 | 0 | 1 | 0 | 3 | 1 | 3 |

| 30489 | FOODS_3_827_WI_3_validation | FOODS_3_827 | FOODS_3 | FOODS | WI_3 | WI | 0 | 0 | 0 | 0 | ... | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

30490 rows × 1919 columns

df_calendar

| date | wm_yr_wk | weekday | wday | month | year | d | event_name_1 | event_type_1 | event_name_2 | event_type_2 | snap_CA | snap_TX | snap_WI | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 0 | 2011-01-29 | 11101 | Saturday | 1 | 1 | 2011 | d_1 | NaN | NaN | NaN | NaN | 0 | 0 | 0 |

| 1 | 2011-01-30 | 11101 | Sunday | 2 | 1 | 2011 | d_2 | NaN | NaN | NaN | NaN | 0 | 0 | 0 |

| 2 | 2011-01-31 | 11101 | Monday | 3 | 1 | 2011 | d_3 | NaN | NaN | NaN | NaN | 0 | 0 | 0 |

| 3 | 2011-02-01 | 11101 | Tuesday | 4 | 2 | 2011 | d_4 | NaN | NaN | NaN | NaN | 1 | 1 | 0 |

| 4 | 2011-02-02 | 11101 | Wednesday | 5 | 2 | 2011 | d_5 | NaN | NaN | NaN | NaN | 1 | 0 | 1 |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 1964 | 2016-06-15 | 11620 | Wednesday | 5 | 6 | 2016 | d_1965 | NaN | NaN | NaN | NaN | 0 | 1 | 1 |

| 1965 | 2016-06-16 | 11620 | Thursday | 6 | 6 | 2016 | d_1966 | NaN | NaN | NaN | NaN | 0 | 0 | 0 |

| 1966 | 2016-06-17 | 11620 | Friday | 7 | 6 | 2016 | d_1967 | NaN | NaN | NaN | NaN | 0 | 0 | 0 |

| 1967 | 2016-06-18 | 11621 | Saturday | 1 | 6 | 2016 | d_1968 | NaN | NaN | NaN | NaN | 0 | 0 | 0 |

| 1968 | 2016-06-19 | 11621 | Sunday | 2 | 6 | 2016 | d_1969 | NBAFinalsEnd | Sporting | Father's day | Cultural | 0 | 0 | 0 |

1969 rows × 14 columns

df_price

| store_id | item_id | wm_yr_wk | sell_price | |

|---|---|---|---|---|

| 0 | CA_1 | HOBBIES_1_001 | 11325 | 9.58 |

| 1 | CA_1 | HOBBIES_1_001 | 11326 | 9.58 |

| 2 | CA_1 | HOBBIES_1_001 | 11327 | 8.26 |

| 3 | CA_1 | HOBBIES_1_001 | 11328 | 8.26 |

| 4 | CA_1 | HOBBIES_1_001 | 11329 | 8.26 |

| ... | ... | ... | ... | ... |

| 6841116 | WI_3 | FOODS_3_827 | 11617 | 1.00 |

| 6841117 | WI_3 | FOODS_3_827 | 11618 | 1.00 |

| 6841118 | WI_3 | FOODS_3_827 | 11619 | 1.00 |

| 6841119 | WI_3 | FOODS_3_827 | 11620 | 1.00 |

| 6841120 | WI_3 | FOODS_3_827 | 11621 | 1.00 |

6841121 rows × 4 columns

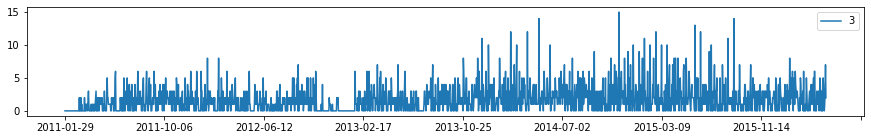

Sample Product¶

Let’s choose a random product and plot it.

df_sample = df_sales.iloc[3, :]

series_sample = df_sample.iloc[6:]

df_sample

id HOBBIES_1_004_CA_1_validation

item_id HOBBIES_1_004

dept_id HOBBIES_1

cat_id HOBBIES

store_id CA_1

...

2016-04-20 0

2016-04-21 1

2016-04-22 3

2016-04-23 7

2016-04-24 2

Name: 3, Length: 1919, dtype: object

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series_sample.plot()

plt.legend()

plt.show()

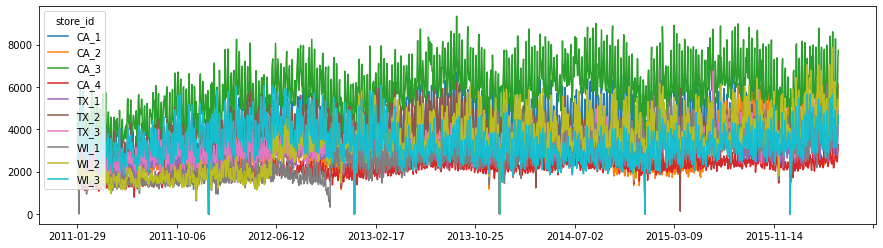

Pick a Time Series¶

Let’s try and find an interesting time series to forecast.

df_sales_total_by_store = df_sales.groupby(['store_id']).sum()

df_sales_total_by_store

| 2011-01-29 | 2011-01-30 | 2011-01-31 | 2011-02-01 | 2011-02-02 | 2011-02-03 | 2011-02-04 | 2011-02-05 | 2011-02-06 | 2011-02-07 | ... | 2016-04-15 | 2016-04-16 | 2016-04-17 | 2016-04-18 | 2016-04-19 | 2016-04-20 | 2016-04-21 | 2016-04-22 | 2016-04-23 | 2016-04-24 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| store_id | |||||||||||||||||||||

| CA_1 | 4337 | 4155 | 2816 | 3051 | 2630 | 3276 | 3450 | 5437 | 4340 | 3157 | ... | 3982 | 5437 | 5954 | 4345 | 3793 | 3722 | 3709 | 4387 | 5577 | 6113 |

| CA_2 | 3494 | 3046 | 2121 | 2324 | 1942 | 2288 | 2629 | 3729 | 2957 | 2218 | ... | 4440 | 5352 | 5760 | 3830 | 3631 | 3691 | 3303 | 4457 | 5884 | 6082 |

| CA_3 | 4739 | 4827 | 3785 | 4232 | 3817 | 4369 | 4703 | 5456 | 5581 | 4912 | ... | 5337 | 6936 | 8271 | 6068 | 5683 | 5235 | 5018 | 5623 | 7419 | 7721 |

| CA_4 | 1625 | 1777 | 1386 | 1440 | 1536 | 1389 | 1469 | 1988 | 1818 | 1535 | ... | 2496 | 2839 | 3047 | 2809 | 2677 | 2500 | 2458 | 2628 | 2954 | 3271 |

| TX_1 | 2556 | 2687 | 1822 | 2258 | 1694 | 2734 | 1691 | 2820 | 2887 | 2174 | ... | 3084 | 3724 | 4192 | 3410 | 3257 | 2901 | 2776 | 3022 | 3700 | 4033 |

| TX_2 | 3852 | 3937 | 2731 | 2954 | 2492 | 3439 | 2588 | 3772 | 3657 | 2932 | ... | 3897 | 4475 | 4998 | 3311 | 3727 | 3384 | 3446 | 3902 | 4483 | 4292 |

| TX_3 | 3030 | 3006 | 2225 | 2169 | 1726 | 2833 | 1947 | 2848 | 2832 | 2213 | ... | 3819 | 4261 | 4519 | 3147 | 3938 | 3315 | 3380 | 3691 | 4083 | 3957 |

| WI_1 | 2704 | 2194 | 1562 | 1251 | 2 | 2049 | 2815 | 3248 | 1674 | 1355 | ... | 3862 | 4862 | 4812 | 3236 | 3069 | 3242 | 3324 | 3991 | 4772 | 4874 |

| WI_2 | 2256 | 1922 | 2018 | 2522 | 1175 | 2244 | 2232 | 2643 | 2140 | 1836 | ... | 6259 | 5579 | 5566 | 4347 | 4464 | 4194 | 4393 | 4988 | 5404 | 5127 |

| WI_3 | 4038 | 4198 | 3317 | 3211 | 2132 | 4590 | 4486 | 5991 | 4850 | 3240 | ... | 4613 | 4897 | 4521 | 3556 | 3331 | 3159 | 3226 | 3828 | 4686 | 4325 |

10 rows × 1913 columns

plt.rcParams['figure.figsize'] = [plot_x_size, 4]

df_sales_total_by_store.T.plot()

plt.show()

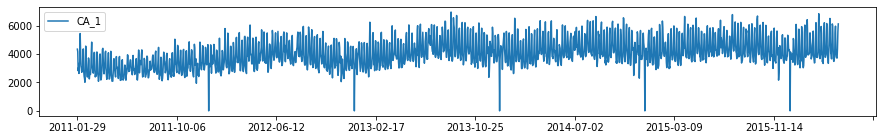

series = df_sales_total_by_store.iloc[0]

print(series.name)

print('Min Dates:' + str(series[series == series.min()].index.to_list()))

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series.plot()

plt.legend()

plt.show()

CA_1

Min Dates:['2011-12-25', '2012-12-25', '2013-12-25', '2014-12-25', '2015-12-25']

2. Pre-processing¶

Before we build a forecasting model, let’s check some properties of our time series.

Is the series non-stationary?¶

Let’s check.

from statsmodels.tsa.stattools import adfuller

result = adfuller(series)

print('ADF Statistic: %f' % result[0])

print('p-value: %f' % result[1])

print('Critical Values:')

for key, value in result[4].items():

print('\t%s: %.3f' % (key, value))

ADF Statistic: -2.035408

p-value: 0.271267

Critical Values:

1%: -3.434

5%: -2.863

10%: -2.568

Does differencing make the series stationary?¶

Let’s check.

def difference(dataset, interval = 1):

diff = list()

for i in range(interval, len(dataset)):

value = dataset[i] - dataset[i - interval]

diff.append(value)

return np.array(diff)

def inverse_difference(history, yhat, interval=1):

return yhat + history[-interval]

series_d1 = difference(series)

result = adfuller(series_d1)

print('ADF Statistic: %f' % result[0])

print('p-value: %f' % result[1])

print('Critical Values:')

for key, value in result[4].items():

print('\t%s: %.3f' % (key, value))

ADF Statistic: -20.626012

p-value: 0.000000

Critical Values:

1%: -3.434

5%: -2.863

10%: -2.568

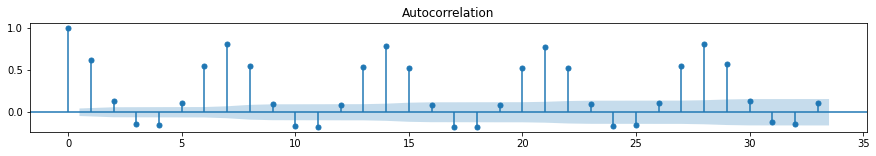

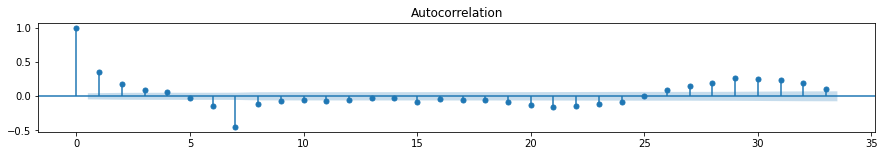

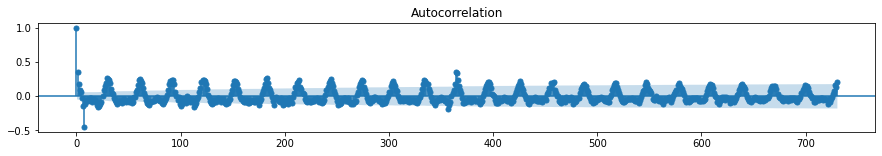

Is the series seasonal?¶

Let’s check.

from statsmodels.graphics.tsaplots import plot_acf

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

plot_acf(series)

plt.show()

plot_acf(series, lags = 730, use_vlines = True)

plt.show()

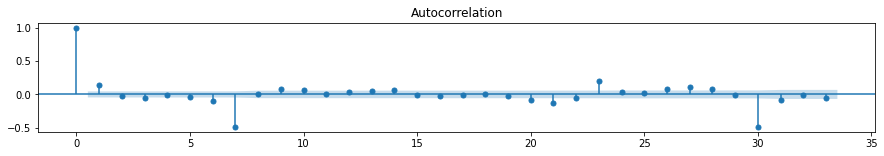

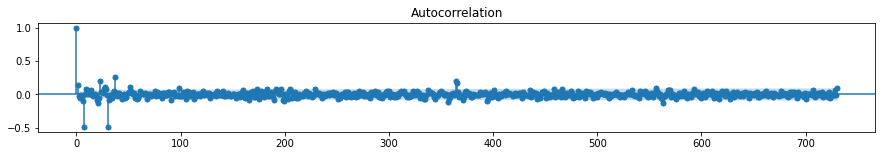

Can we remove the seasonality?¶

Let’s check.

series_d7 = difference(series, 7)

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

plot_acf(series_d7)

plt.show()

plot_acf(series_d7, lags = 730, use_vlines = True)

plt.show()

series_d7_d30 = difference(series_d7, 30)

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

plot_acf(series_d7_d30)

plt.show()

plot_acf(series_d7_d30, lags = 730, use_vlines = True)

plt.show()

result = adfuller(series_d7_d30)

print('ADF Statistic: %f' % result[0])

print('p-value: %f' % result[1])

print('Critical Values:')

for key, value in result[4].items():

print('\t%s: %.3f' % (key, value))

ADF Statistic: -8.405429

p-value: 0.000000

Critical Values:

1%: -3.434

5%: -2.863

10%: -2.568

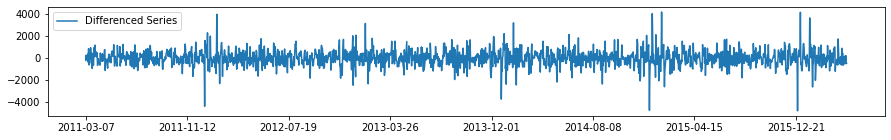

series_d7_d30 = pd.Series(series_d7_d30)

series_d7_d30.index = date_list[37:]

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series_d7_d30.plot(label = 'Differenced Series')

plt.legend()

plt.show()

What now?¶

At this point we have two options:

Model the seasonally differenced series, then reverse the differencing after making predictions.

Model the original series directly.

While (vanilla) ARIMA requires a non-stationary and non-seasonal time series, these properties are not necessary for most non-parametric ML models.

3. One-Step Prediction¶

Let’s build a model for making one-step forecasts.

To do this, we first need to transform the time series data into a supervised learning dataset.

In other words, we need to create a new dataset consisting of \(X\) and \(Y\) variables, where \(X\) refers to the features and \(Y\) refers to the target.

How far do we lookback?¶

To create the new \((X,Y)\) dataset, we first need to decide what the \(X\) features are.

For the moment, let’s ignore any exogenous variables. In this case, what determines the \(X\)s is how far we lookback. In general, we can treat the lookback as a hyperparameter, which we will call window_size.

Advanced note: Technically, we could build an entire methodology for feature engineering \(X\).

Test Set¶

To test our model we will use the last 28 days of the series.

### CREATE X,Y ####

def create_xy(series, window_size, prediction_horizon, shuffle = False):

x = []

y = []

for i in range(0, len(series)):

if len(series[(i + window_size):(i + window_size + prediction_horizon)]) < prediction_horizon:

break

x.append(series[i:(i + window_size)])

y.append(series[(i + window_size):(i + window_size + prediction_horizon)])

x = np.array(x)

y = np.array(y)

return x,y

### HYPERPARAMETERS ###

window_size = 365

prediction_horizon = 1

### TRAIN VAL SPLIT ### (include shuffling later)

test_size = 28

split_time = len(series) - test_size

train_series = series[:split_time]

test_series = series[split_time - window_size:]

train_x, train_y = create_xy(train_series, window_size, prediction_horizon)

test_x, test_y = create_xy(test_series, window_size, prediction_horizon)

train_y = train_y.flatten()

test_y = test_y.flatten()

print(train_x.shape)

print(train_y.shape)

print(test_x.shape)

print(test_y.shape)

(1520, 365)

(1520,)

(28, 365)

(28,)

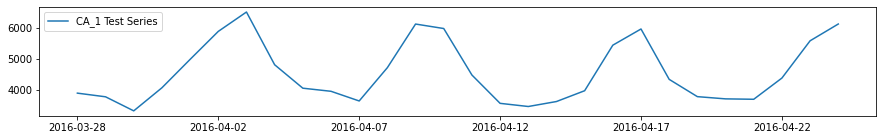

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series[-test_size:].plot(label = 'CA_1 Test Series')

plt.legend()

plt.show()

LightGBM¶

Now we can build a LightGBM model to forecast our time series.

Gradient boosting is an ensemble method that combines multiple weak models to produce a single strong prediction model. The method involves constructing the model (called a gradient boosting machine) in a serial stage-wise manner by sequentially optimizing a differentiable loss function at each stage. Much like other boosting algorithms, the residual errors are passed to the next weak learner and trained.

For this work, we use LightGBM, a gradient boosting framework designed for speed and efficiency. Specifically, the framework uses tree-based learning algorithms.

To tune the model’s hyperparameters, we use a combination of grid search and repeated k-fold cross validation, with some manual tuning. For more details, see the Hyperparameter Tuning notebook.

Now we train the model on the full dataset and test it.

import lightgbm as lgb

params = {

'n_estimators': 2000,

'max_depth': 4,

'num_leaves': 2**4,

'learning_rate': 0.1,

'boosting_type': 'dart'

}

model = lgb.LGBMRegressor(first_metric_only = True, **params)

model.fit(train_x, train_y,

eval_metric = 'l1',

eval_set = [(test_x, test_y)],

#early_stopping_rounds = 10,

verbose = 0)

LGBMRegressor(boosting_type='dart', first_metric_only=True, max_depth=4,

n_estimators=2000, num_leaves=16)

forecast = model.predict(test_x)

s1_naive = series[-29:-1].to_numpy()

s7_naive = series[-35:-7].to_numpy()

s30_naive = series[-56:-28].to_numpy()

s365_naive = series[-364:-336].to_numpy()

print(' Naive MAE: %.4f' % (np.mean(np.abs(s1_naive - test_y))))

print(' s7-Naive MAE: %.4f' % (np.mean(np.abs(s7_naive - test_y))))

print(' s30-Naive MAE: %.4f' % (np.mean(np.abs(s30_naive - test_y))))

print('s365-Naive MAE: %.4f' % (np.mean(np.abs(s365_naive - test_y))))

print(' LightGBM MAE: %.4f' % (np.mean(np.abs(forecast - test_y))))

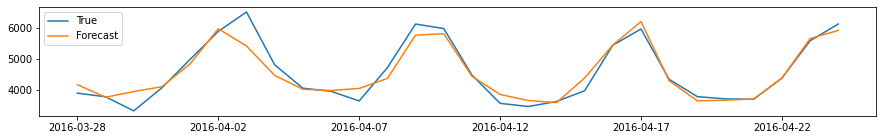

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series[-test_size:].plot(label = 'True')

plt.plot(forecast, label = 'Forecast')

plt.legend()

plt.show()

Naive MAE: 698.0000

s7-Naive MAE: 372.2857

s30-Naive MAE: 330.8214

s365-Naive MAE: 247.9286

LightGBM MAE: 200.5037

Tuning Window Size¶

How does our metric change as we extend the window size?

from sklearn.model_selection import cross_val_score

from sklearn.model_selection import RepeatedKFold

params = {

'n_estimators': 2000,

'max_depth': 4,

'num_leaves': 2**4,

'learning_rate': 0.1,

'boosting_type': 'dart'

}

windows = [7, 30, 180, 365, 545, 730]

results = []

names = []

for w in windows:

window_size = w

train_x, train_y = create_xy(train_series, window_size, prediction_horizon)

train_y = train_y.flatten()

cv = RepeatedKFold(n_splits = 10, n_repeats = 3, random_state = 123)

scores = cross_val_score(lgb.LGBMRegressor(**params), train_x, train_y, scoring = 'neg_mean_absolute_error', cv = cv, n_jobs = -1)

results.append(scores)

names.append(w)

print('%3d --- MAE: %.3f (%.3f)' % (w, np.mean(scores), np.std(scores)))

plt.rcParams['figure.figsize'] = [plot_x_size, 5]

plt.boxplot(results, labels = names, showmeans = True)

plt.show()

4. Multi-Step Prediction¶

Suppose we were interested in forecasting the next \(n\)-days instead of just the next day.

There are several approaches we can take to solve this problem.

### HYPERPARAMETERS ###

window_size = 365

prediction_horizon = 1

### TRAIN VAL SPLIT ###

test_size = 28

split_time = len(series) - test_size

train_series = series[:split_time]

test_series = series[split_time - window_size:]

train_x, train_y = create_xy(train_series, window_size, prediction_horizon)

test_x, test_y = create_xy(test_series, window_size, prediction_horizon)

train_y = train_y.flatten()

test_y = test_y.flatten()

Recursive Forecasting¶

In recursive forecasting, we first train a one-step model then generate a multi-step forecast by recursively feeding our predictions back into the model.

params = {

'n_estimators': 2000,

'max_depth': 4,

'num_leaves': 2**4,

'learning_rate': 0.1,

'boosting_type': 'dart'

}

model = lgb.LGBMRegressor(first_metric_only = True, **params)

model.fit(train_x, train_y,

eval_metric = 'l1',

eval_set = [(test_x, test_y)],

#early_stopping_rounds = 10,

verbose = 0)

LGBMRegressor(boosting_type='dart', first_metric_only=True, max_depth=4,

n_estimators=2000, num_leaves=16)

recursive_x = test_x[0, :]

forecast_ms = []

for i in range(test_x.shape[0]):

pred = model.predict(recursive_x.reshape((1, recursive_x.shape[0])))

recursive_x = np.append(recursive_x[1:], pred)

forecast_ms.append(pred)

forecast_ms_rec = np.asarray(forecast_ms).flatten()

forecast_os = model.predict(test_x)

print(' One-Step MAE: %.4f' % (np.mean(np.abs(forecast_os - test_y))))

print('Multi-Step MAE: %.4f' % (np.mean(np.abs(forecast_ms_rec - test_y))))

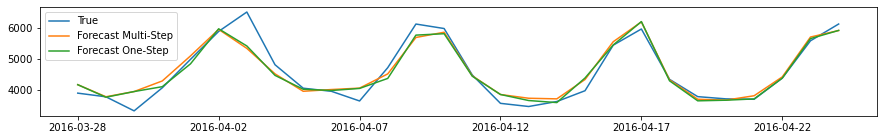

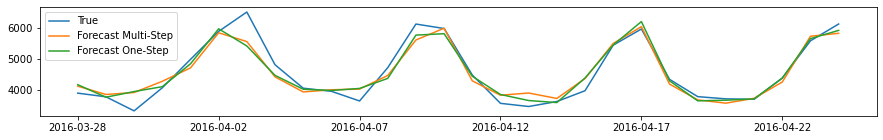

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series[-test_size:].plot(label = 'True')

plt.plot(forecast_ms_rec, label = 'Forecast Multi-Step')

plt.plot(forecast_os, label = 'Forecast One-Step')

plt.legend()

plt.show()

One-Step MAE: 200.5037

Multi-Step MAE: 214.8020

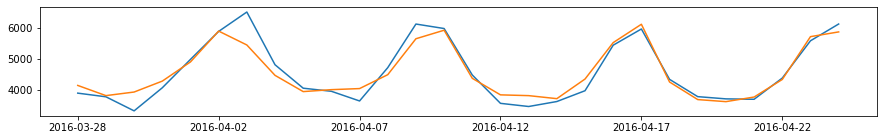

Direct Forecasting¶

In direct forecasting, we train \(n\) independent models and generate a multi-step forecast by concatenating the \(n\) predictions.

For this implementation, we need to create a new \((X,Y)\) dataset, where \(Y\) is now a vector of \(n\) values.

### HYPERPARAMETERS ###

window_size = 365

prediction_horizon = 28

### TRAIN VAL SPLIT ###

test_size = 28

split_time = len(series) - test_size

train_series = series[:split_time]

test_series = series[split_time - window_size:]

train_x, train_y = create_xy(train_series, window_size, prediction_horizon)

test_x, test_y = create_xy(test_series, window_size, prediction_horizon)

from sklearn.multioutput import MultiOutputRegressor

model = MultiOutputRegressor(lgb.LGBMRegressor(), n_jobs = -1)

model.fit(train_x, train_y)

MultiOutputRegressor(estimator=LGBMRegressor(), n_jobs=-1)

forecast_ms_dir = model.predict(test_x)

print(' One-Step MAE: %.4f' % (np.mean(np.abs(forecast_os - test_y))))

print('Multi-Step MAE: %.4f' % (np.mean(np.abs(forecast_ms_dir - test_y))))

plt.rcParams['figure.figsize'] = [plot_x_size, plot_y_size]

series[-test_size:].plot(label = 'True')

plt.plot(forecast_ms_dir.T, label = 'Forecast Multi-Step')

plt.plot(forecast_os, label = 'Forecast One-Step')

plt.legend()

plt.show()

One-Step MAE: 200.5037

Multi-Step MAE: 233.6326

Single-Shot Forecasting¶

In single-shot forecasting, we create a model that attempts to predict all \(n\)-steps simultaneously.

Unfortunately, LightGBM (tree-based methods in general) does not support multi-output models.

Forecast Combination¶

An easy way to improve forecast accuracy is to use several different methods on the same time series, and to average the resulting forecasts.

forecast_ms_comb = 0.5*forecast_ms_dir.flatten() + 0.5*forecast_ms_rec

print(' Recursive MAE: %.4f' % (np.mean(np.abs(forecast_ms_rec - test_y))))

print(' Direct MAE: %.4f' % (np.mean(np.abs(forecast_ms_dir - test_y))))

print('Combination MAE: %.4f' % (np.mean(np.abs(forecast_ms_comb - test_y))))

series[-test_size:].plot(label = 'True')

plt.plot(forecast_ms_comb, label = 'Forecast Combination')

plt.show()

Recursive MAE: 214.8020

Direct MAE: 233.6326

Combination MAE: 217.0313

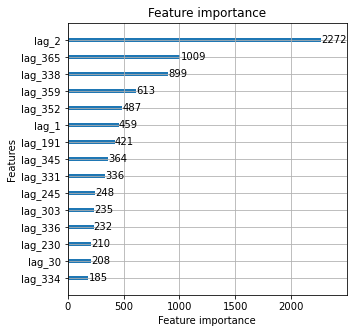

5. Feature Importance¶

One advantage of GBM models is that it can generate feature importance metrics based on the quality of the splits (or information gain).

### HYPERPARAMETERS ###

window_size = 365

prediction_horizon = 1

### TRAIN VAL SPLIT ###

test_size = 28

split_time = len(series) - test_size

train_series = series[:split_time]

test_series = series[split_time - window_size:]

train_x, train_y = create_xy(train_series, window_size, prediction_horizon)

test_x, test_y = create_xy(test_series, window_size, prediction_horizon)

train_y = train_y.flatten()

test_y = test_y.flatten()

params = {

'n_estimators': 2000,

'max_depth': 4,

'num_leaves': 2**4,

'learning_rate': 0.1,

'boosting_type': 'dart'

}

model = lgb.LGBMRegressor(first_metric_only = True, **params)

feature_name_list = ['lag_' + str(i+1) for i in range(window_size)]

model.fit(train_x, train_y,

eval_metric = 'l1',

eval_set = [(test_x, test_y)],

#early_stopping_rounds = 10,

feature_name = feature_name_list,

verbose = 0)

LGBMRegressor(boosting_type='dart', first_metric_only=True, max_depth=4,

n_estimators=2000, num_leaves=16)

plt.rcParams['figure.figsize'] = [5, 5]

lgb.plot_importance(model, max_num_features = 15, importance_type = 'split')

plt.show()

Summary¶

In summary, this section has shown the following:

A quick exploration of the M5 dataset and its salient features

Checking the usual assumptions for classical time series analysis

Demonstrating the ‘out-of-the-box’ performance of LightGBM models

Demonstrating how tuning the lookback window can effect forecasting performance

Demonstrating how tuning the hyperparameters of a LightGBM model can improve performance

Summarizing the different approaches to multi-step forecasting

Illustrating that gradient boosting methods can measure feature importance

Many of the methods and approaches shown above are easily extendable. Of note, because of the non-parametric nature of most machine learning models, performing classical inference tasks like hypothesis testing is more challenging. However, trends in ML research have been moving towards greater interpretability of so-called ‘black box’ models, such as SHAP for feature importance and even Bayesian approaches to neural networks for causality inference.

References¶

[1] S. Makridakis, E. Spiliotis, and V. Assimakopoulos. The M5 Accuracy competition: Results, findings and conlusions. 2020.

[2] S. Makridakis, E. Spiliotis, V. Assimakopoulos, Z. Chen, A. Gaba, I. Tsetlin, and R. Winkler. The M5 Uncertainty competition: Results, findings and conlusions. 2020.

[3] V. Jose, and R. Winkler. Evaluating quantile assessments. Operations research, 2009.

[4] A. Gaba, I. Tsetlin, and R. Winkler. Combining interval forecasts. Decision Analysis, 2017.